Under the Hood - Demystifying VC | 0.04

This week: Decentralized finance, and how to break into the venture capital industry

Hi, it’s Julius and Maria from the HEC Paris Alternative Investments Society VC team. Happy new year from the entire team!

Today, we’re covering the Decentralized Finance space with two sections:

Market Spotlight - Coming of age: The future of decentralized finance

Demystifying VC - Tips and resources for acing your VC Analyst Interview

🔎 Coming of age: The future of decentralized finance

(by Julius Müller)

Decentralized finance - yet another solution looking for a problem, truly the future of finance, or something in between? Let's have a sober look under the hood of a crypto enthusiast's darling industry and try to assess whether the buzz warrants VC attention in 2021 and beyond.

Below is the shortened version. For an even more in-depth look, head over HERE.

🚀 The state of DeFi or what is all the fuss about anyway

Decentralized finance can be somewhat of a slippery term to grasp. I'd say the most fit-for-purpose definition is the one that industry news site Binance offers:

"DeFi may be defined as the movement that promotes the use of decentralized networks and open-source software to create multiple types of financial services and products. The idea is to develop and operate financial DApps [Decentralized Applications] on top of a transparent and trustless framework, such as permissionless blockchains and other peer-to-peer (P2P) protocols."

In theory, DeFi applications utilize the inherent capabilities of the underlying blockchain infrastructure - although objectively, some of those advantages do not materialize in this current iteration of the market.

Some of the most popular live DeFi use cases, and personal highlights below:

Decentralized exchanges, where users can exchange tokens without an intermediary

Lending platforms, where collateral in form of tokens can be locked in to secure a loan

Insurance platforms, where collateral in form of tokens is used in automatic insurance contracts

Derivate trading & asset management, where crypto assets are traded & managed

Identity systems, that enable KYC processes on-chain

Stablecoins, tokens that are pegged to another asset, in the most popular cases to the US Dollar, to minimize volatility and facilitate payments

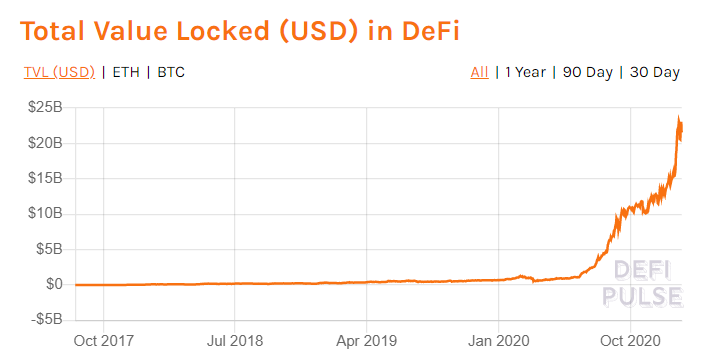

The fact of the matter is that DeFi has seen considerable buzz on the back of the wider crypto craze that has captured the industry the past couple of months. Just take a look at the explosion in "total value locked in DeFi" over the past couple of months alone:

Source: Defi Pulse (accessed Jan 14th, 2021)

Industry beat writers have been quick to herald this as a sign that "mainstream adoption" of the space is just around the corner.

I think that is very far fetched if not flat out false. It's much more the sign of an overheated, and highly inefficient, market-driven by "yield farming"; the behavior in which traders constantly move tokens around to benefit from arbitrage opportunities on different exchanges and networks. Vitalik Buterin, the founder of Ethereum, hit the nail on the head on that problem.

All in all, does this warrant the buzz around decentralized finance? Anyone looking at the market clear-eyed today must confess that the answer should be no. However, the state of the market today might not be indicative of its future potential.

The DeFi promise

The problem

A major criticism of DeFi and blockchain in a wider context has been, since the inception, that it solves a problem that doesn't exist. Here are two major issues that I believe DeFi has the potential to actually solve:

1.7bn people in the world remain unbanked

Inclusion has been a central idea in the DLT-space ever since the Bitcoin whitepaper in 2008. I believe DeFi applications can provide a major push to include 'everyone' in the financial system. Interestingly, the World Bank estimates that of the 1.7bn unbanked, 1.1bn have access to a mobile device and could access financial services if offered the opportunity. Services run on legacy architecture will have a hard time reaching those people because the infrastructure to serve the unbanked is often not available.

That's underscored by the observation that most of the services that target the unbanked nowadays are peer-to-peer services. Decentralized finance was built both on the internet and on a peer-to-peer basis by default which makes the adoption easy everywhere you have an internet connection. DeFi might just be the next logical evolution.

There is little 'true' innovation in finance

I've honestly been genuinely disappointed by a majority of Fintechs that have made big waves in recent times. Financial innovation is very centered on the notion of "take something where incumbents provide a terrible experience and move it online while ditching most of the legacy infrastructure". Don't get me wrong - Neobanks are great. Mobile trading apps are also great. Sending money across borders actually works largely frictionless now, at least in some countries.

But I'm missing innovation that truly changes how people approach to finance. Every transaction eventually ends in bank-to-bank communication, thus inhibiting innovation. Legacy infrastructure has seen incremental optimization to make it faster, more secure, and more robust. But paired with strict regulations, it still inhibits disruptive potential. The necessary backlink to the banking infrastructure prevents entrepreneurs to truly re-think transactions of value.

The Solution

I believe that blockchain infrastructure has the potential to supplement, if not replace, the legacy banking infrastructure that was never built to last into the internet age. "The currency of the internet" can open up new ways to conduct finance in ways that are not possible with existing infrastructure. I think an early sign could be 'IoT-enabled' payments between interconnected machines. On a production line, for example, continuous messages might be sent to 'the network' on production progress. That might trigger logistics processes and payouts based on observed speed and passed quality requirements of the manufactured good. The sheer complexity and frequency of micro-transactions could catapult some DeFi applications into the spotlight.

Financial innovation can be facilitated through a combination of factors:

Permissionless innovation. DeFi developers can implement disruptive ideas without the restrictions of a permissioned system. Innovative financial services that run on the legacy system are restricted by decades of compounding regulation and code. DeFi provides a testing ground for developers to build new approaches to finance without those restrictions; for example who can apply to loans or get access to certain asset classes. Effective regulation will undoubtedly play a major role in bringing the ideas to the mainstream but the experimentation is often better done in an open environment.

Combinatorial innovation. Open-sourced code can become a building block for future innovation. The blockchain industry has thus far adopted an open-source-first approach on public blockchains and the influx of new developers in 2021 could see an exponential increase in code and innovation. There is virtually no other industry where this is a possibility. One can only hope that open source remains a cornerstone in the future - a tough proposition when competitive interests will increasingly play a prominent role.

Interoperability. Decentralized ledgers inherently remove silos between market players. This could allow solutions that are truly industry-wide. Every bank nowadays employs developers building virtually the same thing. All this brainpower could be put to better use.

Borderless. Geographic borders greatly inhibit the spread and speed of innovation. Even in the VC space, considerable capital is employed to expand beyond borders. In addition, manpower must focus on figuring out the legal, cultural, and regulatory environment of the target market. Financial innovation that is 'born global' can employ more capital and focus full attention on developing the product.

This framework should spawn true financial innovation in 2021 and beyond.

Five takes on the future of the industry

1. 2021 will see the most promising DeFi applications yet...

I believe the most promising DeFi applications will hit the market somewhere in early 2022 after being built largely in stealth mode. This might also be the last chance for investors to enter into the wider crypto market at somewhat reasonable valuations. I agree with Naval Ravikant's statement on yet another great appearance on the Tim Ferris Show that investors thinking about joining the market now have already missed the optimal timing by at least a couple of years.

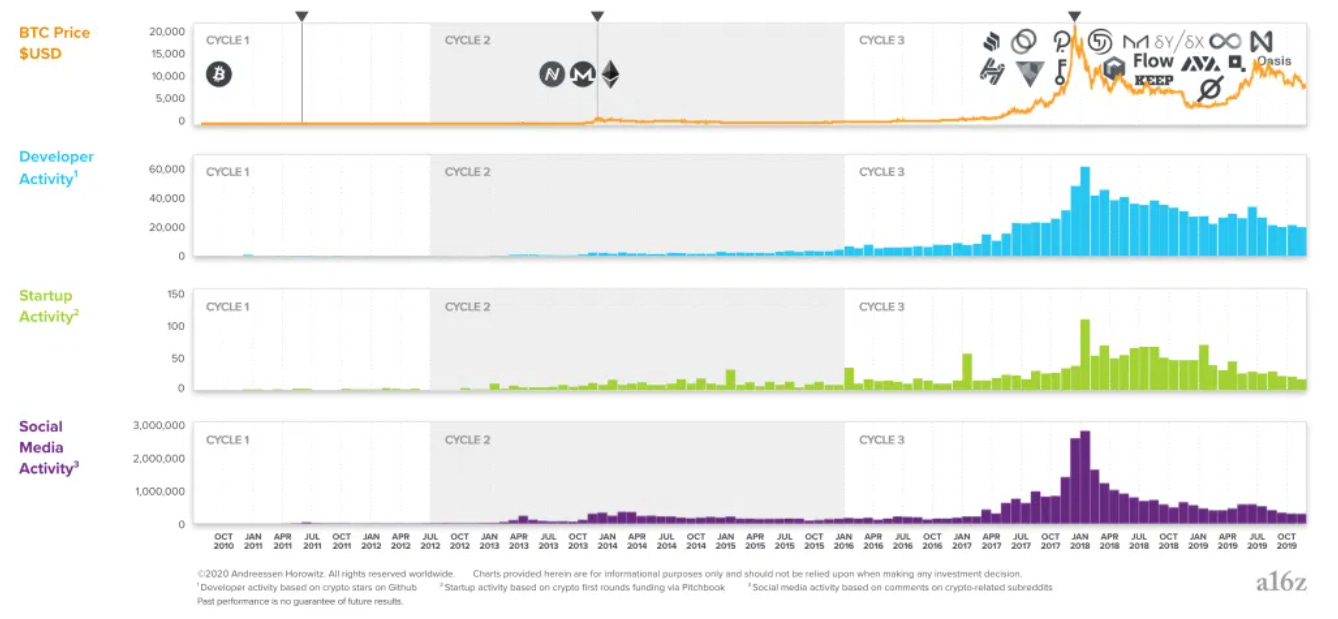

However, 2021 will see the hottest DeFi applications being built yet - a16z's Chris Dixon and Eddy Lazzarin, whose firm has collectively been extremely bullish on crypto for a while now, have visualized an absolute intuitive correlation between innovation and market craze (the entire article is well worth the read):

Source: Andreessen Horowitz, 2020

A period of market craze is usually followed by a "crypto winter" in which the most promising start-ups are created. I think it's pretty safe to say at this point that we are currently in the midst of the fourth hype cycle with asset prices soaring to all-time highs in early January. While crypto assets will likely settle at a higher average price than before, I'm certain that a sharp correction will follow.

I also believe this to be a good thing. As showcased by a16z, some of the most promising applications have been built in those heated markets. The DeFi space in general really took off - MakerDAO's first whitepaper for example was published in late 2017 but only really took off in the subsequent years. Its stablecoin DAI still remains one of the most instrumental coins in the DeFi space.

2. ...but DeFi will only truly take off once it's not reliant on Ethereum.

Interoperability is the key enabler to watch in the industry. In this context, interoperability defines the ability to exchange messages and/ or assets across multiple distinct blockchains. The general idea encompasses specialized chains tailored to the specific use case. Transactions cross-chain should be as seamless as transactions on-chain for DeFi to really take off. Chain interoperability is paramount for mainstream adoption. Ethereum's Vitalik Buterin laid out the technical foundations back in 2016 and those still hold today.

Most of DeFi today runs on Ethereum with the aforementioned stablecoin DAI as the most widely adopted token of exchange. I don't believe that this is sustainable. The vision is that every asset should in theory be accessible to trade on any chain in the wider network. Otherwise, the industry just replicates digital silos - just in a novel way. Even with the emergence of Ethereum 2.0, the reliance on one network inhibits the potential of the industry. It makes transactions slower, more expensive, and prevents innovation through the lock-in on one platform.

I think the industry requires a concentrated effort of moving away from Ethereum - or at least expanding way beyond it. I'm particularly excited about Polkadot, established by Ethereum Co-Founder Gavin Wood together with Robert Habermeier and Peter Szaban. They are more well-known today than they were in early 2019 when I first had the opportunity to speak with them in the context of a research paper on chain interoperability. The idea of connecting multiple chains will be a central one for DeFi going forward. Others working on this include Cosmos, Fusion, or Wanchain.

3. The first DeFi unicorn will emerge in Africa.

Bringing disruptive innovation on an infrastructure level into a financial field that is characterized by strong regulation and embedded legacy systems in the western world will take time. The current live use cases reflect that quite well - speculators have understood that DeFi is a better casino than Wall Street at this point in time - 24/7 uptime, little regulation, ample arbitrage opportunity, higher yield, more risk. Will that market environment breed a unicorn that survives its infancy? Probably not. I believe the regulatory risk is too high for VCs to really double down on backing start-ups trying to re-create the financial system on-chain in the 'developed world' - for now anyway. The controversy surrounding FinCEN's proposed new regulation illustrates the struggle that lies ahead in the West. (For the curious, here is a16z's open letter as a response)

Bringing decentralized finance to the second most populous continent on earth is a much better bet. There is a major business case for financial inclusion on the continent and the environment seems favorable for DeFi adoption:

No major legacy infrastructure. The first major use cases, especially in Sub-Saharan Africa, already focused on peer-to-peer transactions. Those ran on the internet infrastructure - I believe a logical evolution of those systems is the introduction of blockchain technology to provide safety and governance features.

Weak governance & high political risk. While one must be careful not to generalize over an entire diverse country, research shows that the majority of countries still deal with high political risk, especially in central and east Africa. That provides a fertile breeding ground for a decentralized system that inherently minimizes country risk.

Strong adoption of mobile financial services & huge market potential. Consultancy McKinsey & Company already reported back in 2017 that "Africa is the global leader in mobile money" with East Africa leading the charge. BCG reports that the market potential of mobile banking in sub-Saharan Africa alone is close to $500B - almost all of which are expected to be primarily peer-to-peer services.

4. DeFi will not make a dent in replacing the developed world's legacy infrastructure this decade but will provide a major extension.

Learning from Facebook's Libra fiasco, FinCEN's regulatory Christmas present and the [EU's crypto regulation proposal](https://www.sygna.io/blog/what-is-mica-markets-in-crypto-assets-eu-regulation-guide/#:~:text=The European Commission's Regulation of, all member states by 2024.): as long as there is no substantial interest from a consortium of incumbents at stake, new approaches will be struck down citing security risk, the potential of fraud, and scalability concerns. But good to know anyway that EU regulation will be ready in its first iteration in 2024.

Therefore, the most impactful DeFi applications of the decade in the 'developed world' will bridge traditional and decentralized finance. Incumbents are showing interest and are increasingly taking action to get a share of the pie. Or just to ensure survival, really. Crypto.com and BCG Platinion find that 58% of surveyed financial institutions fear a competitive disadvantage of DeFi applications in the future if they miss the train leaving the station now. That makes sense - the most promising applications operate on the fringes of their businesses for now but quicker access to loans, insurance contracts, derivatives trading, and asset management could create such a pull that even protective regulatory bodies will move quickly to find solutions for official approval.

Collaboration with the incumbents will be the coming of age moment for the DeFi community - it goes against an ideal that is engrained into the general mindset of the community that the current system is beyond broken and must be replaced. However, if they do show a willingness to work together with both regulators and incumbents, they might yet achieve more in mature markets than they ever could by running a contrarian approach.

5. DeFi application must finally behave like Fintechs.

DeFi applications have so far received the benefit of "a technical shroud" where applications that feel complicated and techy are actually preferred by early adopters. Since the scene's origin is in the hacker and cryptography sphere, that approach worked well for building out the early infrastructure. However, applications being built in 2021 must adopt user-centric design at their core. The industry must also do better publicity for its own sake - less technical terms; more focus on design, solutions; simple messaging; less talk about abstract world disruption.

Coinbase is arguably the most successful crypto platform out there although their business model is the absolute antithesis to decentralized finance - the platform is as centralized as it can get and its transaction fee system is more reminiscent of legacy banks than Fintechs in the trading space, e.g. Robinhood or German equivalent Trade Republic. But they have succeeded in opening up the crypto world to newbies by taking out the complexity of the space. Decentralized exchanges, like uniswap and especially the recently very popular Curve, should look to replicate that style.

Crypto enthusiasts will not drive the next iteration of DeFi - they are already using it. I believe there are promising products out there already but they are missing a layer of abstraction from the technical foundation to appeal to even the majority of tech-savvy users before being ready to "cross the chasm" and break into the mainstream market:

Source: Geoffrey A. Moore: "Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers"

Become the smartest person in the room

The Quiet Master of Cryptocurrency - Nick Szabo in conversation with Tim Ferris and Naval Ravikant. If there is only one resource you consult to understand the origins of DeFi and the crypto space in general, this is the one.

Polkadot Lightpaper - Understand chain interoperability

🎯 Demystifying VC: Acing your VC Analyst Interview

(by María Artiles)

Why you should consider a career in Venture Capital

The venture capital industry began in 1946 when Georges Doriot, the father of venture capital, and others started the American Research and Development Corporation, the first publicly owned venture capital firm. Their best investment was the $70,000 they spent in 1957 to help fund Digital Equipment Corporation. Eleven years later, that investment was valued at more than $355 million after the company’s initial public offering!

Now, seven decades after, the industry remains strong, really active, and as interesting as ever. Globally, in Q3‘20 VC-backed companies raised $73.2B across nearly 5,000 deals. According to Forbes, "2021 is shaping up to be a bumper year for venture-backed deals". In spite of the impact in the world of lockdowns and restrictions, the startup environment has proven quite resilient and in fact, seems to be counter-cyclical to the macroeconomy as most VCs are now back and active in the market. PitchBook research confirms that most countries are seeing some of their highest deal levels ever and the year is on a pace to top 2019 in terms of capital deployed into venture deals, and VCs are as active as they were pre-Covid now.

So, is it a good moment to break into VC? YES, IT IS! Apart from the obvious reasons of wanting to pursue a VC career (fun and challenging tasks, financially rewarding, having access to the best minds in the world, and having the chance to make a difference), the current environment makes working as a venture capitalist a unique shot to learn and make the most out of the opportunities provided by the crisis. The dry powder in the market, the disruption which is affecting every industry (putting pressure on organizations to act quickly) will offer big opportunities in the number of transactions we will see in the market. VCs cannot afford to lose a step in this volatile environment, which will make the experience extremely interesting and rewarding.

Moreover, the VC model is changing, with the inclusion of platform and network elements in the value offering of VCs to startups. This can be a unique opportunity to gain exposure to the operational aspects of building a startup.

Here are two excellent resources to help you figure out if you really want to work in VC:

But we are not going to lie, venture capital is a hard career path to break into, which is why you must nail your interview. VC is also far more heterogeneous than pretty much any other field — there’s a wide variety of professionals’ backgrounds, firms’ strategies, and many other aspects. For that, there’s really no consistent interview guide like, for example, in IB or consulting.

In an attempt to white-box the process to some extent, we've talked with VC analysts who have recently done their interviews in top VCs and put together a set of tips and resources so you can prepare and ace your VC interview and be part of this exciting world.

'Typical' interview questions and resources to prepare for them

Something that you CAN'T fail at is the fit and background questions, as they are not only interested in your technical skills but probably more in you and your personality. These include the classic behavioral and motivation questions about your resume, why venture capital, why this firm, your strengths, and weaknesses, where do you see yourself in 5 or 10 years, etc.

Moreover, the interviewer will probably ask you market and investment-related questions: Which startups would you invest in? Which markets do you find interesting? For this, you should have a strong market awareness (in at least 2-3 areas of your and the VCs interest), read VC and start-up related news, but also pay attention to other macro and market-focused topics.

For firm-specific and process questions, know the VC as if it was a family member of yours, and have an opinion about their investment thesis and portfolio companies: What kind of companies do they invest in? What do you think about their portfolio? Which companies would you have invested in or not invested in? How would you analyze a potential investment and make a decision?

If you have experience working in adjacent industries such as Investment Banking, expect questions regarding deal, client, and fundraising experience: How did you add value in the IB deals you’ve worked on? If you worked at a startup, how did you win more customers or partners in a sales role?

Finally, regarding technical questions, you could get standard finance questions about accounting and valuation, as well as VC-specific questions about cap tables, key metrics in a specific industry, and how to value startups and size markets.

We have compiled below a list of resources HERE that you can refer to for your preparation. Feel free to write to us to suggest more resources! The guide consists of:

Fit and Technical Questions

Understanding Startup Valuation

Finance Questions

Guide to Case Studies

Brain Teasers

Thank you for reading! Don’t hesitate to write to us at julius.muller@hec.edu or maria.artiles@hec.edu to share feedback, resources, or to submit requests for future deep-dives!