Hi, it’s Julius and Aarzoo from the HEC Paris Alternative Investments Society VC team.

Under the Hood is a bi-weekly newsletter about recent developments in the Venture Capital industry, our perspective on key trends, and deep dives into how VC works.

Today, we’re covering the API-first companies space with five sections:

Market Spotlight - This section includes a summary of our deep-dive on the API-first companies space. The complete research is hosted on Notion and you can access it here.

Deal in the Spotlight - Twilio’s $3.2B acquisition of Segment

Fantasy Portfolio - The $22M Series B of our first portfolio company Abacus.ai

What intrigued us this week - a16z’s new funds, Sequoia’s plans for Europe, VC recruiting resources

What we are up to at HEC AIS - Events we host in December

🔎 Market Spotlight

(by Aarzoo Sharma)

Our first market spotlight covers the API-first trend. The rise of API-first companies (such as Shopify, Stripe, Twilio, Plaid, and Segment) and the fact that API startups raised $1.06 billion in venture funding in 2018 made it interesting for us to dig into this space.

The complete deep-dive is hosted independently on a Notion page and you’ll find below a summary of the key points we address! Check out the market deep dive HERE.

What are APIs, anyway?

Simply put, APIs (Application Programming Interfaces) are computing interfaces that allow software applications to talk to each other. They facilitate communication (exchange of data) between software and can be designed for any level of granularity - go further with Mulesoft’s super intuitive explanation of what an API is.

APIs have been a key part of companies' tech stacks for almost 20 years - they were first popularised by Salesforce, eBay, and AWS in the early 2000s as a means to integrate services in the backend. They then went on to enable some of the most important technologies of the past decade – social (APIs enabled the success of Facebook and Twitter), cloud (AWS proved that infrastructure could be deployed cheaply using APIs), and mobile (APIs enable interconnectivity of mobile apps).

Thanks to major shifts in the technological landscape (detailed in the next section), APIs form a key part of the tech stack of most products today.

The evolution of SaaS

To understand why APIs are shooting up in importance, it is worthwhile to look at the evolution of SaaS companies (go further on Notion). In this section of the deep dive, we talk about:

How SAP and Salesforce helped lay the foundations for the SaaS explosion of the past decade.

How the commodification of cloud computing and infrastructure management technology supported the rise of SaaS.

Why APIs are central to building defensibility in SaaS, with a focus on Systems of Record/ Engagement/ Intelligence.

The core value proposition of API-first companies

The push of the software industry towards an on-demand, bottom-up, consumer-like adoption model is driving the API-powered product trend. With more SaaS inclusion in the system, it has become more natural for companies to use APIs in their own products as well. Given the flexibility and modularity of APIs, the possibilities for endpoints to create and connect are endless. We see three key areas where API-first companies can add value to their (enterprise) customers.

Enable seamless and personalized customer experiences through microservices.

Supercharge teams across functions by speeding up experimentation cycles and reducing time to market.

Foster collaboration (and innovation) across the value chain.

Market timing - where can API-first companies capture value?

We see two key areas where API-first companies can really capture value:

Enabling digital transformation: The growth in cloud computing and the fact that 'every company is now a tech company' has led to the ever-increasing need for integration (across industries). We're already experiencing a great deal of API adoption in the software, finance, and e-commerce industries. However, we think that there is still quite some untapped potential in 'traditional' industries such as construction, logistics, and manufacturing.

Facilitating the shift from on-premise to the cloud for companies that are just getting started on their digital transformation journeys.

Enabling additive manufacturing and communication across the value chain (Agile ERP, Agile MES, Agile PLM).

Developing custom API systems for SMBs that might lack internal technological know-how.

Boosting vertical B2B marketplaces by creating a smoother search, listing, checkout, and tracking experiences.

More people are becoming developers thanks to no-code: APIs fit in perfectly with the rise of no-code tools and the greater speed of experimentation that comes with using them. Startups are now starting to target citizen developers with their APIs, and there is value to be created on both sides of the table, as proven by the phenomenal rise of Zapier.

Autonomous management of APIs to help API developers focus more on designing APIs rather than testing and debugging them.

Enabling data access for 'citizen developers' to capitalize on the 'everyone is an analyst' trend.

Facilitating API discovery in what is likely to be a crowded space.

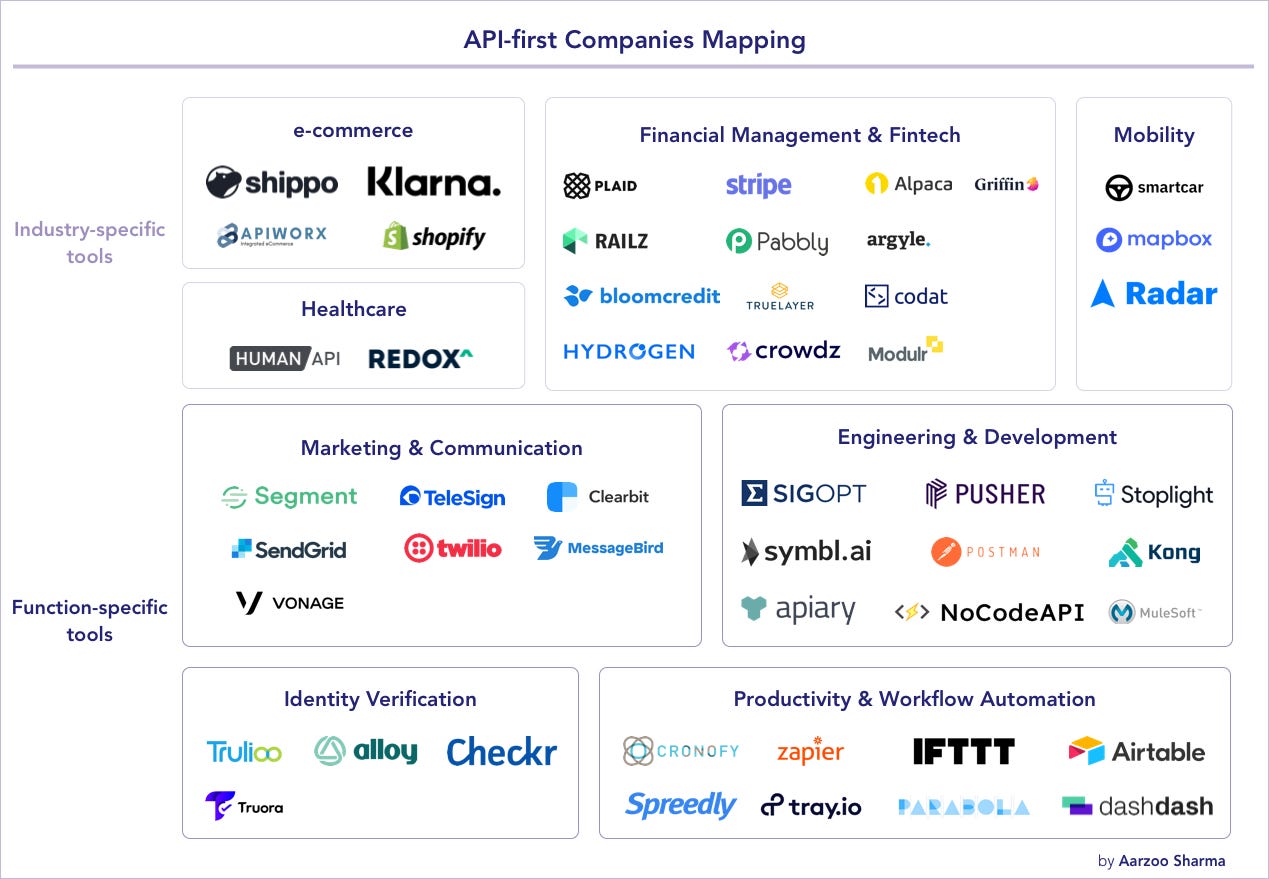

API-powered companies mapping

Here is a (non-exhaustive) mapping of API-first companies. Let us know in the comments if we missed any exciting ones!

Conclusion: What you would need to believe in

While the API-first trend is super interesting, we think that there are several hoops startups would have to jump through to really make it big.

Achieving Product-Market Fit in addition to building a strong technical foundation for their offering will be critical. We also believe that in the long run, API-first companies would have to look to capture more of the value chain and provide a more comprehensive service before they run the risk of being marginalized as an API-only company that serves a purely transactional purpose.

Educating customers on how they can derive the maximum value from their tool and getting the attention of IT teams/ developers (read: building brand awareness) in what is likely to be a noisy space is going to be critical.

Building brand equity, especially in situations where the startup is a category creator could be essential to driving future growth.

Unlocking the usage-feedback flywheel to build the best possible product for their target customers.

Please feel free to share your thoughts on the Notion page via comments! We would love to hear from you.

🔦 Deal in the spotlight

(by Julius Müller)

Twilio acquires Segment for $3.2B in a key move for an API-first company to capture more of the value chain in managing customer data.

Key facts about Segment and the deal:

Value Proposition: Segment collects user events from web & mobile apps and provides a complete data toolkit across the entire enterprise.

Founded: September 2011 / HQ: San Francisco, USA

Twilio Acquisition: $3.2B all-stock transaction

Latest Funding Round: Series D in Apr 2019 at a $1.5B valuation | Funding: $175M (total $283.7M)

Estimated ARR: €130M

Notable Investors: Accel, GV (Google Ventures), Meritech Capital Partners, Thrive Capital, e.ventures

Segment is on a mission to “empower every team with good data” through a set of APIs and tools that allow customers to connect various sources of customer data in one data pipeline to facilitate a single view of the customer. In the words of Co-Founder Peter Reinhardt: “Segment is the last analytics integration you’ll ever do”.

🚀 Why you should really care about this deal

Twilio has risen from a modest start-up founded in 2008 with APIs that allowed companies to integrate text and voice services into their app into a tech behemoth with close to $48B in market capitalization. The Segment acquisition is the latest act in a series of moves that transition the company from an API-provider to an integrated customer data management platform in multiple verticals when combined with the $2B SendGrid acquisition in 2018 and their own product expansion. We believe this to be a natural progression in the market, as outlined in our market spotlight, and we’ll be looking at other API-first companies to make a similar step. Who will swoop up automation platform Zapier for example to complement their offering? Another candidate would be CRM platform Intercom (interestingly, Twilio apparently was in talks with the company in 2015 for an acquisition - now they might be too big of a fish to fry for them).

Segment is a developer-first company. Its acquisition highlights the prevalence of such an approach to building tech-companies. The key to that success is both a deep understanding of their target segment and constant engagement. As Jack Gecawich has argued in a popular blog post a couple of months ago, “If you’re building a developer-first company, […] you need to be obsessive about the developers who are going to build on top of you.” Segment was committed to this from the very beginning and, somewhat expected of a YCombinator-backed company, they were engaging with the community from day one (you might want to check out this early post on the popular HackerNews platform with an MVP of what has now become a multi-billion dollar company).

By the way, we talked about microservice architecture and the API-first companies that facilitate them in our market spotlight. You’ll be interested to know that Segment has shared some strong negative views on the use of microservices in their organization and beyond (where, we reckon, a number of endpoints of communication services are the ones of their now-parent-company). The development will indeed be interesting to observe.

🤔 What you need to believe in

Twilio can accelerate Segment’s growth post-acquisition. The success of this deal will depend heavily on how successful Twilio is in cross-selling Segment’s offering to their existing 200k+ customers and thereby accelerating market access for the target’s product. Since Twilio stated that such acceleration is the key investment rationale here, we will be watching the growth of Segment as a business unit of Twilio closely (something that will be easier now that they are part of a public company). We agree with most market observers that Segment is a clearly complementary product to Twilio’s existing offering and it will be interesting how their push into a full-fledged customer data management platform pans out. This could pave the way for other API-first companies to follow suit.

💸 Fantasy Portfolio

(by Julius Müller)

Our first portfolio company Abacus.ai raised a $22M Series B round led by Coatue, with Decibel Ventures and existing investor Index Ventures participating as well!

The company is democratizing access to sophisticated AI models so that every company can effortlessly embed cutting-edge AI into their applications. We anticipated them raising a follow-up round in Q1/2021 in our investment memo and are delighted to see that they showed enough traction for other VCs to close a follow-up round even sooner than that.

Check out last edition’s in-depth investment memo HERE.

In addition to raising new capital to fuel their growth, we feel like they also seemingly addressed some of the points we outlined in our assessment that could take the company to the next level:

Abacus segmented their product into different offerings that allow companies to adapt the service to their needs. We think this potentially opens a major part of the market where companies might not need the entire platform but might want to use specific parts of the service with upgrade options later down the line.

They doubled down on their self-service-solution-that-rivals-tech-giants-in-sophistication USP and intend to use the funds to build up their engineering prowess. While we believe that technology alone will not be a sufficient differentiator to stand up against tech giants moving into that market segment (as outlined in our memo), combining that engineering advantage with their efforts in offering customization options makes for a sustainable competitive advantage.

We continue to be bullish on the future prospects of the company and will keep you updated on any developments!

📚 What intrigued us this week

Renowned US VC firm Sequoia Capital opened their European office earlier this year. As they scale up their presence on the continent, they shared insights into their plans and why they reversed their position on Europe

Equally renowned US investor a16z announced a staggering $4.5B in additional capital that they will deploy in two new funds

A reader shared an exciting resource with us that covers VC news & job offerings. Thanks for the suggestion! (Funnily enough, the publisher of that resource co-founded a start-up based in Berlin in which an AIS VC team member gained his first internship experience a couple of years ago - the world is indeed small)

Berlin-based VC fund, btov is recruiting for three roles (German-speaking intern, analyst/ associate) - check out the listing here!

🎫 Save the Date

“Cevian Capital | Fireside Chat” on 01.12.2020. Europe’s largest activist investment firm Cevian Capital will chat with us about the industry.

Chat with Digital+ Partners on 03.12.2020. HEC AIS will host the B2B technology growth equity investor.

“Early-stage investing in 2020 and beyond” in the second week of December. VCs at European powerhouses Redalpine & HV Capital will share insights on funds they closed in 2020 and European early-stage investing.

Thank you for reading! Don’t hesitate to write to us at aarzoo.sharma@hec.edu or julius.muller@hec.edu to share feedback, resources, or to submit requests for future deep-dives!

Great insights!